Biogas

Your biogas plant in a strong pool

As the operator of one of Europe's largest Virtual Power Plants, we are helping to bring about the energy transition by putting your biogas plant on the markets. Our goal is to increase the profitability of your bioenergy unit, relying on our experienced trading team to sell the power generated by your biogas plant at the best possible price. We achieve the required capacity to operate on all markets by linking together thousands of units, which enables us to offer trading options that maximize the revenue from your biogas asset.

Power trading

Benefit from our experience on the electricity exchanges

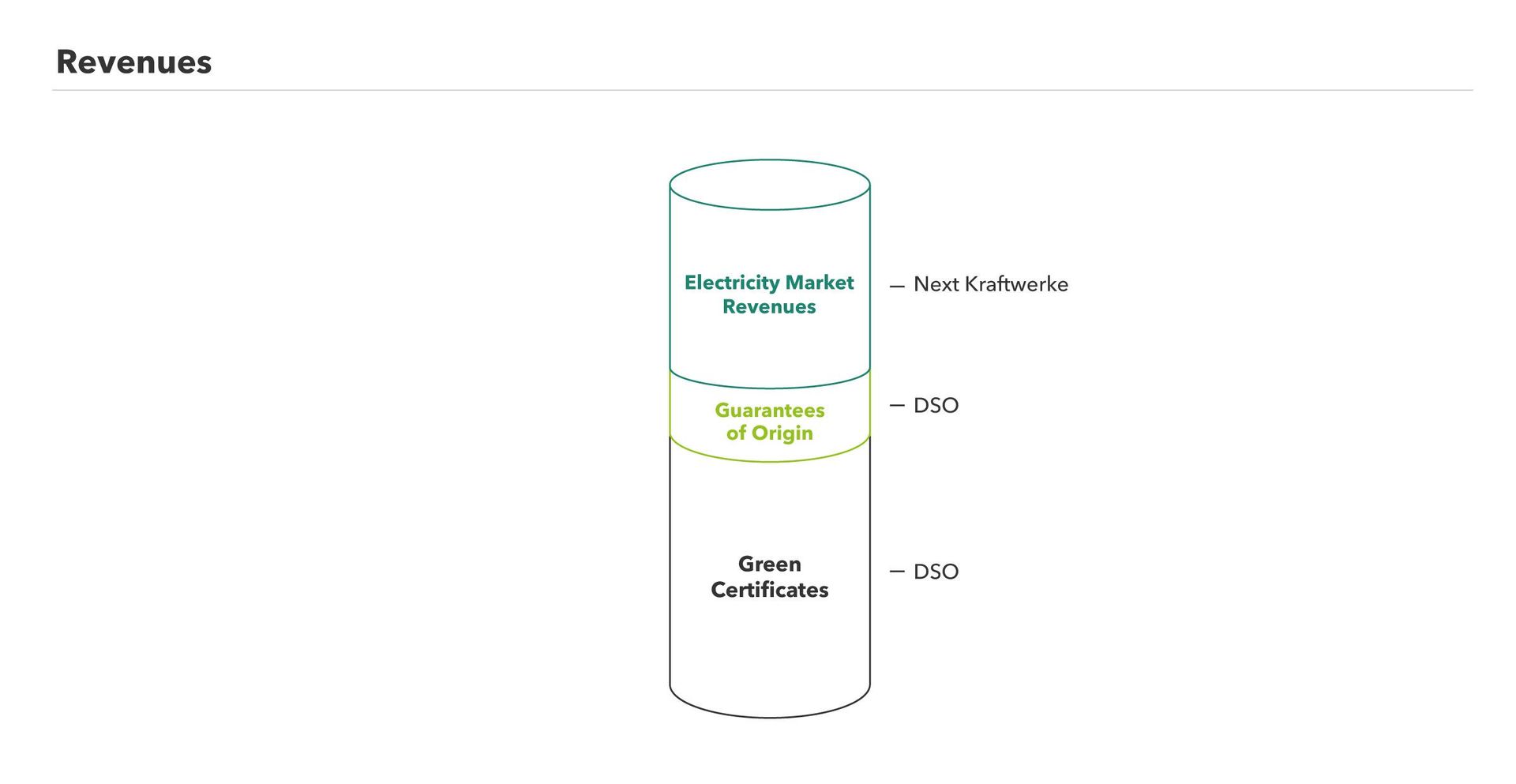

Besides the Green Certificates for CHPs, you are also entitled to sell the power you inject into the grid on the electricity markets. Next Kraftwerke is a licensed trader who can do this for you.

Easily implemented: We trade the power your plant produces on the electricity markets for you. Nothing changes in the day-to-day operation of the plant. You feed your energy in as usual.

Lucrative: Our in-house trading team trades your biogas power on the spot market of the power exchange. You receive the market revenues for the injected power.

Service-oriented: Our experts support you. From the connection to our Virtual Power Plant to customer service - we are at your side.

Optimised production

Steering your power plant to higher revenues

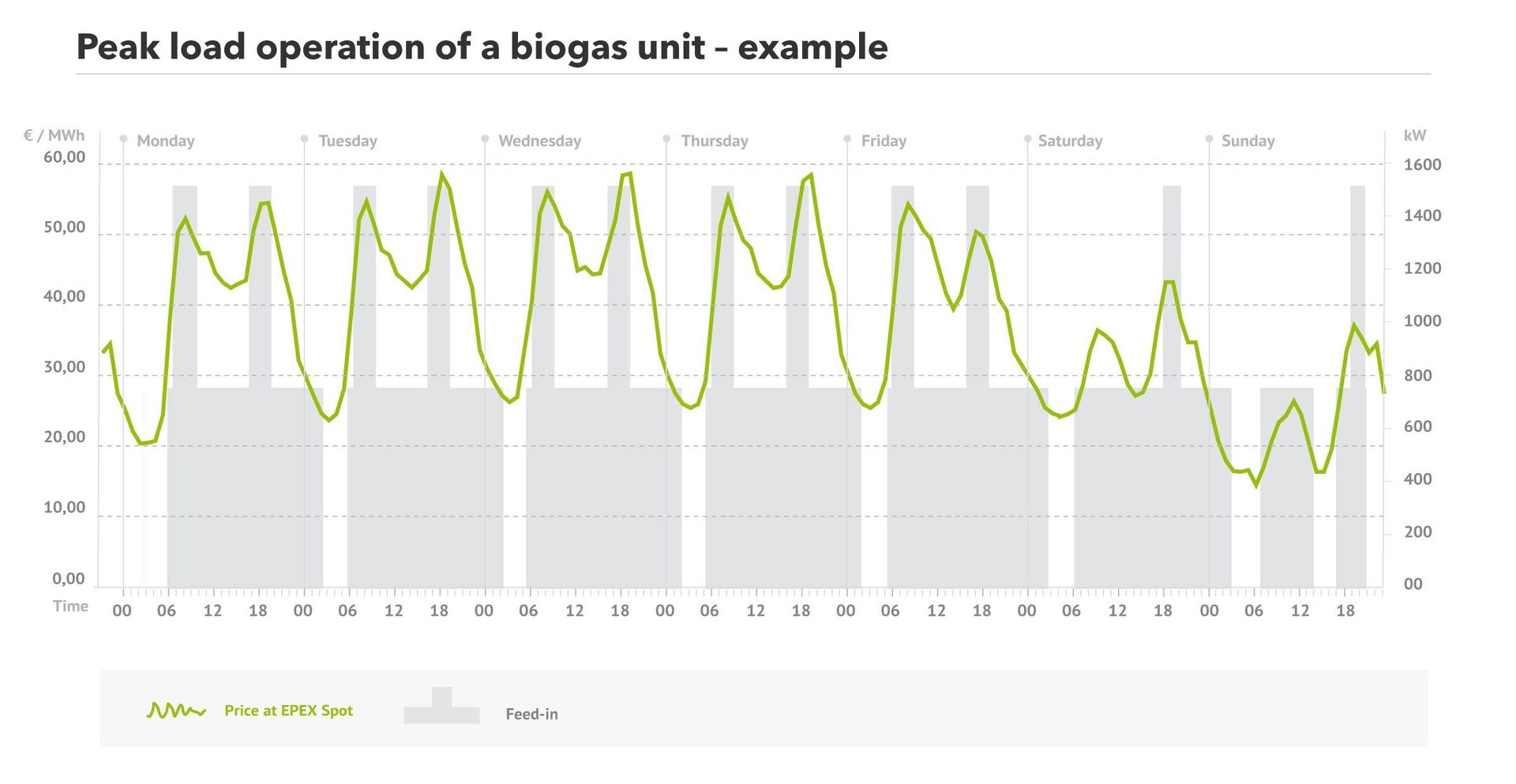

The market price of power changes 24 times per day on the day-ahead market, and 96 times daily in intraday trading. The difference in price between individual quarter-hour segments can be more than 100 euros per megawatt hour. Therefore, it is worthwhile to align power production with periods of high market demand. We work together on an operating schedule for your biogas plant, with a target output above the monthly average. Our forecasts are based on live data from thousands of assets in our Virtual Power Plant.

Individually tailored to your plant: Switching cycles, power limits, heat delivery obligations or even feeding times are recorded in the restrictions.

Full control: Via the customer portal, you can control and adjust the starts and stops of your plant.

Maximum flexibility: You decide whether you create your schedules yourself or whether we take over schedule creation and following the optimized schedule completely.

All markets: We monitor the DayAhead and Intraday markets and always select the best one for you.

Balancing power

The flexibility of your plant is valuable!

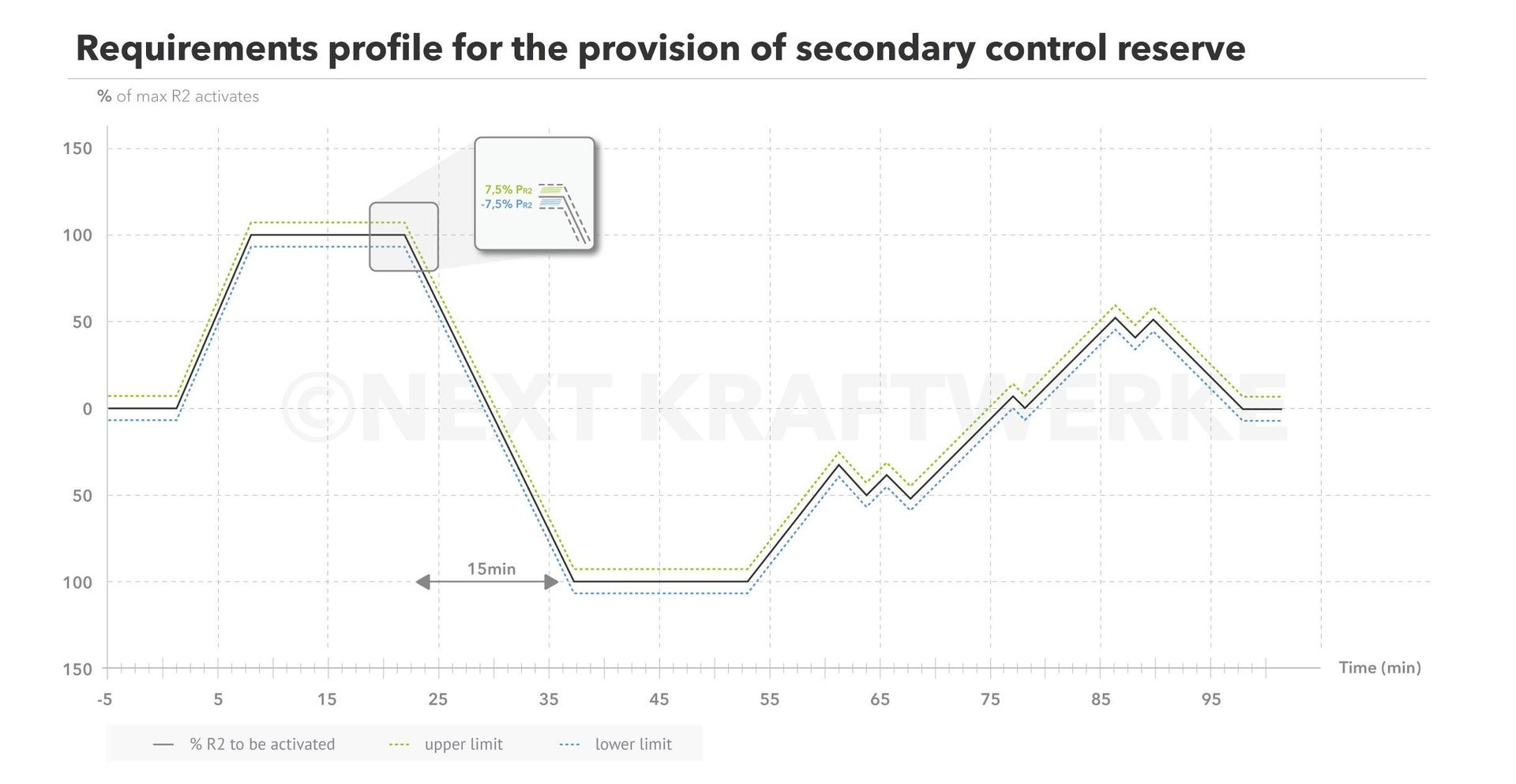

Solar and wind assets produce varying amounts of power depending on the weather, which leads to fluctuations in grid frequency. To balance out this fluctuation, Transmission System Operators (TSOs) need control reserve - something you can provide with your biogas plant. Nuclear and coal power plants cannot quickly adjust their output. The same goes for wind and solar plants, which are dependent on the weather. However, your biogas asset can make quick adjustments to power production, and this flexibility is a valuable asset on the control reserve market.

Full-Service: To actively participate in the balancing markets, your plant needs to be prequalified with the TSO. We take care of this process for you.

Gain additional revenues: After successful prequalification, your biogas plant is valorised in the reserve power market and is rewarded with a capacity remuneration, and in some cases an activation remuneration.

Profit optimization: If your biogas plant is also in the demand oriented operation, we analyze where your flexibility is worth the most, and place it there.

Future-oriented: With participation in the balancing energy market, you contribute to the security of supply and thus to the success of the energy transition.

Next Portal

Always up to date via app and PC

Using our client portal "Next Portal", available on PC or via mobile app, you can follow the status of your biogas installation in real-time, change personal data, and consult your monthly credit notes.

View performance values: You can see what your biogas plant feeds in and how high your revenues turn out.

Fault notification: Via the App, you will be informed about any malfunction or interruption of the connection of your installation to the virtual power plant. That way, you can always react as fast as possible in case it would be needed.

Report maintenance times: You also have the option to announce unavailability of your plant due to a planned maintenance etc. This way, we know when your plant is not available to be traded.

FAQ Biogas

Frequently asked questions

Here you will find answers to many questions concerning the integration of your biogas plant into the virtual power plant. We will also be happy to answer your questions personally. Just get in touch with us!

In order to trade your biogas power at the best conditions, our trading team needs real-time production data of the installation. Therefore, a data exchange is set up. This can either be done via an online interface or through the Next Box.

Next Box: The Next Box is your link to the Virtual Power Plant. Communication between your biogas asset and our control system is conducted over a secure mobile connection, fulfilling a legally-prescribed requirement on an asset’s remote-control capacity. The Next Box also makes it possible to operate your asset according to a price-based schedule, which opens up additional trading options.

Control system: All assets in the Virtual Power Plant provide data to our control system, giving us a constant overview of the available aggregated capacity. Nearly all commands executed by the Virtual Power Plant control system are automated using M2M communication. The strictest security and safety standards are maintained at all times.

Our in-house power traders market your biogas power in day-ahead and intraday trading on EPEX SPOT in Paris, the European power exchange for short-term wholesale power trading. For additional revenue, we can place your biogas plant on the transmission system operators' balancing energy market.

Our experienced team of analysts and brokers trades the electricity you have generated on the EEX and EPEX Spot power exchanges. The data contained in the Virtual Power Plant plays an important role here: Live feed-in and draw-off data from thousands of units form the basis of our precise forecasts. This is supplemented by constantly-updated market data from several exchanges and the results of our own meteorological analyses. By combining these data sets, we can trade renewable energies competitively and contribute to further integration of decentralized assets on the market.

We offer three optimized schedule options: Peak 7, Peak 24 and Peak 96.

Peak 7: We create a custom, weekly operating schedule for your asset based on current pricing forecasts and the asset's operating restrictions. The asset's operating schedule can be manually executed or automated by our control system using the Next Box. Even if you opt for automated execution, you maintain full control of your motor’s starts and stops in the customer portal. Higher profits are possible if you are able to spontaneously adjust operation based on changes in the weather or sudden moves on the market. In this case, additional options for peak-load operation are available.

Peak 24: Up-to-date market forecasting is an important factor in determining profit margins of power production. With our Peak 24 rate, we create a custom, daily operating schedule, incorporating the latest price forecasts and the operating restrictions specific to your asset. This requires more frequent updates to the operating schedule, meaning control of your asset needs to be managed by the Next Box if you opt for the Peak 24 rate. You still retain full control of your asset through the customer portal and can adjust starts and stops of your biogas unit.

Peak 96: The Peak 96 rate is best way to optimize peak-load operation. Your biogas asset receives operating commands every fifteen minutes. This takes full advantage of price fluctuation and maximizes profit. Operation of your asset on the optimized schedule is fully automated using our control system and the Next Box. The customer portal provides full access to your asset's operation with Peak 96 as well. You always maintain control.

Primary, secondary, and tertiary reserve are traded by the Belgian TSO Elia in auctions on the control reserve markets. Market participants submit initial bids for a capacity price, which are sorted by amount in a merit-order list. For secondary and tertiary reserve, providers with winning bids take part in a second auction and submit bids for the unit price. If the control reserve is needed, providers with the lowest price receive the tender first. Higher bids then follow in order. If a control reserve order is placed, secondary and tertiary reserve providers are also paid the additional unit price. While FCR and aFRR are tendered on a weekly basis, mFRR is tendered on a monthly basis. In addition, Elia tenders part of its FCR power on the regional market regelleistung.net.

More information on Balancing Energy

FCR, aFRR and mFRR explained

Primary reserve capacity is the first to be activated to prevent a power outage and is the most attractive type of control reserve to sell. It must be available within 30 seconds, and delivery must continue uninterrupted for at least 15 minutes. Checks are conducted as part of prequalification tests to identify how much positive and negative capacity can be produced in this time frame. This ‘capacity range’ can be sold on the control reserve markets after a bidding process conducted in advance. Unlike the tertiary or secondary reserve, primary reserve is not activated by a command from the TSO. Instead, it is triggered by grid frequency. This is measured directly on the biogas asset; depending on the deviation, the asset immediately delivers positive or negative primary reserve. Due to the constant availability, there is no difference between the capacity price and the energy price - compensation is automatically set at the capacity price.

The Belgian TSO Elia procures four different FCR products: two symmetrical and two assymetrical. The symmetrical products are FCR 100 mHZ and FCR 200 mHZ, respectively responding in a frequency deviation band of +- 100 mHz and +- 200 mHz around 50 Hz. The assymetrical products require an activation in only one direction, respectively upwards or downwards for FCR upward and FCR downward. The different products are shown in the figure above.

Secondary reserve capacity must be available within 7.5 minutes to take over from the primary reserve. Large assets and aggregators receive a power setpoint directly from the TSO's SCADA system, in order to work away imbalances within the TSO's control area. Offering secondary reserve capacity in the capacity auction is rewarded via the capacity price, while activations are compensated based on the energy bids.

Currently, secondary reserve power can only be offered by power plants with a CIPU-contract. Next Kraftwerke has actively encouraged Elia to open the market since 2015. To prepare for this market reform, the Belgian TSO decided to organise a pilot project in 2017 to assess the feasibility of R2-delivery by aggregated assets on the MV and LV grid. Next Kraftwerke participated in this pilot project and reached a response compliancy better than some conventional power plants that deliver secondary reserve power today. Therefore, Elia is now in the process of opening the market for non-CIPU-installations. Next Kraftwerke is strongly involved in shaping the new market rules to ensure a smaller assets can benefit from the opening of the aFRR-product.

Tertiary reserve capacity balances grid fluctuations following a lead time of 15 minutes. The TSO measures frequency and places orders to call up capacity.

Grid operator Elia procures two different mFRR products: R3 standard and R3 flex. The first one can be activated for up to 8 hours per day, while the latter can be activated for maximum 2 hours continuously – between two activations there has to be a pause of at least 12 hours. The grid operator pays a capacity remunerations for both products, but only for R3 standard an energy remuneration is awarded.

Numbers & Facts

Employees

Aggregated Units

Networked Capacity

Share of biogas plants in the Next Pool

Volume of traded energy

Prequalified R1 (in Europe)

Everything under one roof

In our Virtual Power Plant, all the necessary aspects for marketing electricity come together under one roof: Our engineers, electricians, and power traders work closely with the sales and customer service teams to ensure that members of the Next Pool receive the best possible rates for their biogas assets.