Power Trading in the Wholesale Electricity Markets

Definition

Power trading refers to the act of purchasing and selling power between participants in the electricity sector. Various forms of power trading are possible depending on the market design, ranging from anonymous short-term spot markets to long-term over-the-counter markets. These markets allow trading of electricity between power producers, large industrial consumers, and electricity retailers before it is being delivered to end consumers. They are therefore often called the wholesale electricity markets.

A short history of power trading

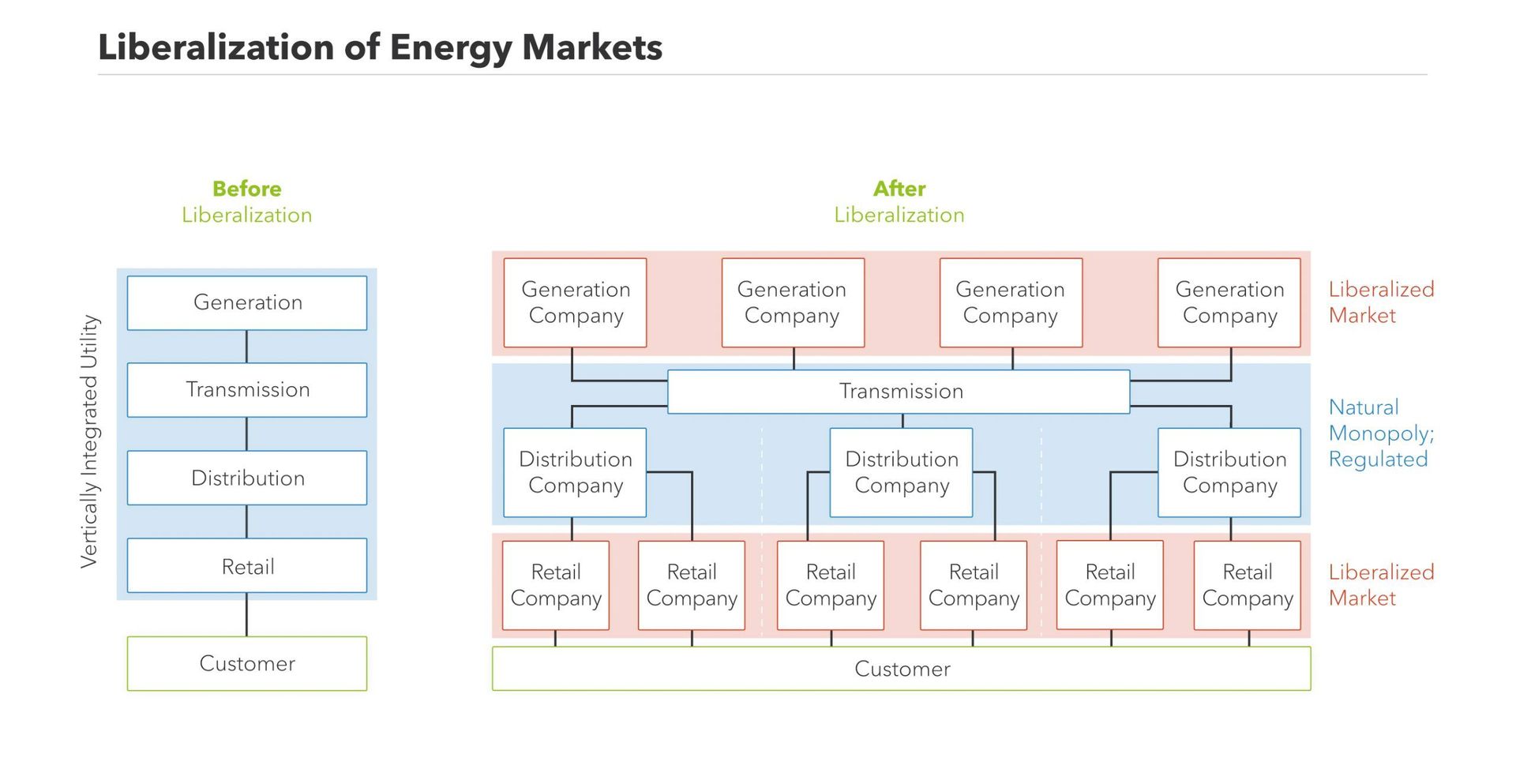

As in most parts of the world, the electricity sector in Europe used to be a vertically integrated and monopolized sector. One or a few companies were responsible for the generation, transmission, distribution, and supply of energy. These utilities were usually state owned.

A first wave of liberalization took place in South America, after Chile liberalized its energy market in 1980. In Europe, Margaret Thatcher introduced a reform to privatise, liberalise, and de-integrate the English electricity system. After the introduction of the Electricity Act of 1989, the sector was overhauled in the matter of a few years. At the other side of the English Channel, the idea of a liberalized and internal electricity market for Europe started taking shape in Brussels. After the introduction of the first Energy Package in 1996, the sector underwent a gradual transformation towards an unbundled and competitive energy system.

In a vertically integrated electricity system, there is little need for power trading. In the end, the production of electricity is done by the same company that supplies it to all end customers in a certain grid area. After unbundling and privatization are introduced, this is no longer the case. In that case, tens if not hundreds of market parties need to match their expected demand and available production in the electricity markets.

The consecutive wholesale markets in Belgium

Electricity is one of the most versatile forms of energy. It is very different from other energy commodities because electricity can still not be stored cost-efficiently at a large scale. This means that in our power system generation and consumption must equal one another at every moment in time. To be able to cope with this particular property, different wholesale markets are organized on different time horizons in advance of the actual moment of production and consumption.

On the long term, producers and consumers can trade large blocks of power in the futures or forward markets years before actual delivery. These derivate markets allow markets parties to safeguard (or in a trader’s language: hedge) themselves against unpredictable fluctuations in electricity prices. In Belgium, futures are traded on the ICE Endex and European Energy Exchange (EEX). Another option is that two companies make a deal between one another, then often called an Over-The-Counter (OTC) contract (more on that below).

Spot markets, on the other hand, allow the trade of electricity for same-day or next-day delivery. The most important one is the day-ahead market, which usually closes at noon for next-day delivery. Compared to the forward markets, a more precise estimate of the demand for the day ahead is possible based on weather data, big events that might influence demand (like an important football match) and information about power plant outages. In Belgium, the day ahead market is managed by EPEX Spot Belgium and the electricity is traded on an hourly basis.

The day-ahead demand forecast will never be completely accurate. Production forecasts, too, will differ from what was expected, due to different wind conditions, solar insolation, or unexpected plant outages. Therefore, the intra-day market was introduced to allow spot trading even closer to the moment of delivery. In Belgium the intra-day market is organized by EPEX Spot Belgium, the resolution is 15 minutes, and trading takes place on a continuous basis.

In reality, this market-based approach will always result in a remaining imbalance in the power system both because traders might not have been able to make all necessary deals and because generation and consumption can never be predicted with 100% accuracy. This final imbalance must be taken care of by the transmission system operator. In Belgium, this is Elia. For this purpose, Elia activates so-called reserve power products. Find out more in our article about electricity markets.

Over-the-counter (OTC) versus exchange-traded

Power trading can not only be distinguished based on the time horizon it takes place on, but also on the way the deals are reached. In the energy sector, there are three common approaches: via a power exchange, through an over-the-counter (OTC) deal, or with an organized OTC market which is cleared continuously.

The power exchanges

Power Exchanges are used for anonymous, transparent, and hassle-free trading. A multilateral trading platform is set up, where market participants submit demand or supply bids for a standardized product for which demand is high enough to ensure sufficient liquidity. The day-ahead spot market is, for example, usually organized through a power exchange and clearing takes place based on the principle of the merit order curve.

The intraday spot market is also organized through a power exchange in Belgium, but clearing takes place on a continuous basis. Market participants submit anonymous supply and demand bids just like in the day-ahead market, and bids are matched on a continuous basis. Interested parties can also click on an open offer to close a deal. The continuous intraday market is therefore also called an organized over-the-counter (OTC) market.

The largest spot exchanges in Europe are the EPEX Spot and the Nord Pool, but there are also several local markets.The EPEX Spot is the spot-market exchange for Central Western Europe, the United Kingdom, Switzerland, the Nordics and Poland. The Nord Pool is the spot market for Denmark, Estonia, Finland, Germany, Latvia, Lithuania, Norway, Sweden, Belgium, France, Austria, the Netherlands and the United Kingdom. To ensure better market coupling and to allow cross-border intraday trading, EPEX Spot, Nord Pool, GME and OMIE established a harmonized trading system called XBID.

OTC markets

OTC markets are used for bilateral trading outside of the power exchanges. In OTC trading, trading partners are in direct contact with each other or make use of a broker. The transactions themselves occur on trading platforms online or through the broker. Agreements on trading volumes and pricing are reached bilaterally among the parties, but contractual standards for simplification and risk mitigation are gaining acceptance. OTC trading is a common practice in the energy market, representing the largest volume of electricity market transactions in many countries.

Even though OTC trades can be used for spot market deals, the growing liquidity and ever shorter gate closure times of power exchanges make OTC deals less interesting for short term trading. For the trading of forwards or futures for more than 24 hours before delivery, OTC trading is still the only option available.

In regular exchange-based trading, trading prices and volumes are public knowledge. In OTC trading, this information is only available to the contracting parties. Although OTC trading has the advantage of potentially lower fees and transaction costs, the barriers for market-entry are higher than on the exchange. On the one hand, the OTC deal is not a standardised product and involves more work to close. Compared to exchange trading, this increases the flexibility of OTC trading, but also increases the risk. On the other hand, significant financial guarantees need to be provided by both parties.

To lower the risks associated with OTC trading and to simplify trading transactions, some exchanges such as the European Energy Exchange (EEX) in Leipzig now offer standardized OTC contracts. If desired, these can be settled using European Commodity Clearing (ECC). These standardized contracts, such as the EFET framework contract, are usually templates that are still adapted as desired by the contracting parties.

Read more

Power Purchase Agreements (PPAs)

Power Purchase Agreements are often long-term contracts between (renewable) power producers and an offtaker, be it a trader, retailer, or large consumer. They are especially common in countries where renewable generators either receive a market indexed subsidy or no subsidy at all. In essence, a PPA is nothing else than an OTC-deal with a renewable producer. More on PPAs in this article.

The future of power trading

The electricity markets in Europe are continuously evolving. To achieve the European Commission’s goal of an internal European electricity market that is competitive and reliable, the day-ahead markets of all Member States have been coupled. As part of the XBID project, the intraday markets are increasingly being linked too since 2018.

To support the integration of variable renewable energy generators, the time horizon and gate closure time of the standard spot products are being reduced. At the same time, renewable generators increasingly look for financial security by closing long term PPAs which take volume out of the spot markets. How these different dynamics will impact the spot markets in the long run is still to be seen.

One thing is clear though: trading volumes in the spot markets increase year after year, and the increasing variability of demand and supply introduce more price volatility.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.