What is the merit order curve in the power system?

Definition

In the energy industry, the term ‘merit order’ describes the sequence in which power plants are designated to deliver power, with the aim of economically optimizing the electricity supply. The merit order is based on the lowest marginal costs. Power exchange markets are operated by a middleman to whom generators and consumers submit their bids. In Belgium, the intermediate party for both the day-ahead and the intra-day market is EPEX Spot Belgium. As discussed in the section on energy markets, the day ahead market is a power exchange market, while the intraday market is an organized over the counter market. The mechanism to determine the clearing price and volumes in a power exchange market is based on the merit order curve.

Table of Contents

The merit order as basis for the day ahead market mechanism

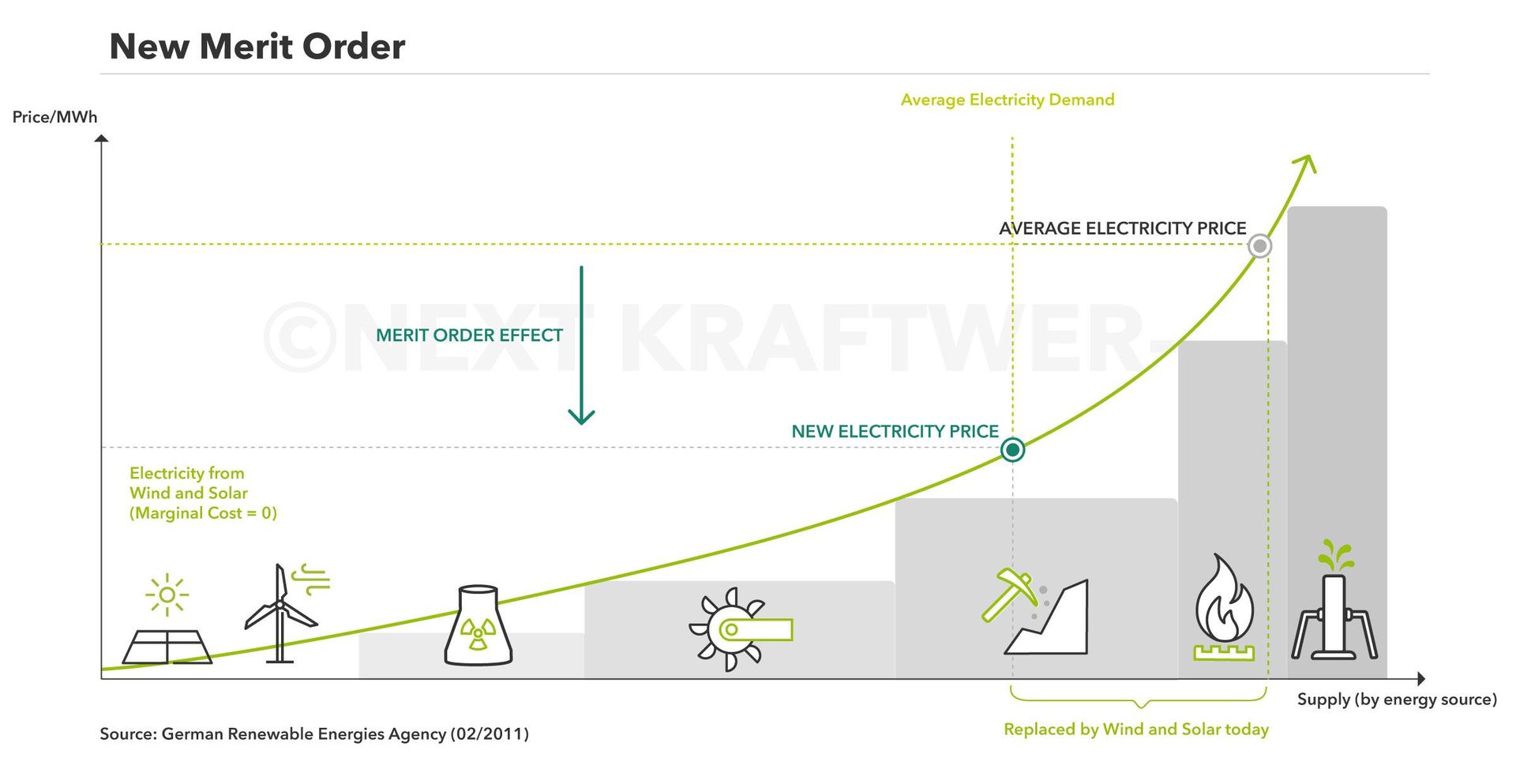

For every predefined period of 1 hour, the generation bids are aggregated to one supply curve. Since the bids are ranked according to increasing price, this curve is referred to as the merit order curve. Renewables have very low marginal costs (the sun and the wind are for free) and are found at the bottom of the curve. Nuclear has also a low running cost and follows the renewables in the ranking. For low (or non-existing) carbon permit prices, the running costs of a coal plant are typically lower than those of a combined cycle gas plant (CCGT, also known as STAG plant). Peak plants, which are meant to cover rare peaks in demand (for example on an exceptionally cold winter day) are often diesel or gasoline fueled and therefore have the highest running cost. An illustration of the merit order curve is given in the figure below.

The market operator will also aggregate the demand bids to form the demand curve. The intersection of the demand and the supply curve determines the clearing price and the clearing volume. All generation market participants will receive this clearing price for the electricity they inject in the grid. Equally, the market participants who take off electricity will all pay that same price, being the clearing price.

When observing the merit order curve, one will notice that an increase in renewable energy bids will drive down the clearing price (for the same demand curve) and push the more expensive units out of the market. This is the reason why wholesale market prices in for example Germany have decreased strongly since the beginning of the energy transition, or as folks in Germany call it, the Energiewende. Also in Belgium the wholesale prices have decreased over the last years. This is not necessarily reflected in lower electricity bills for the end-consumer, because the energy component makes up for only one third of the bill. Taxes, levies and distribution tariffs make up for the other two-thirds.

Read more

One also observes that the market clearing power plant receives its marginal cost, while for the other plants the clearing price is higher than their running cost. The difference between the clearing price and the marginal cost is known as the inframarginal rent. Inframarginal rents are needed to recover fixed generation costs. Only if the market clearing price is higher than the sum of the marginal and fixed cost for most of the time, the technology will be attractive for investors. Investment in generation capacity is of crucial importance for the security of supply. To lower investment risks in generation capacity, grid operators can implement capacity mechanisms.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.