What are Balancing Energy Markets?

Definition

As in other European countries, transmission system operator Elia monitors the balance of the Belgian grid. It requires each Balancing Responsible Party (BRP) to maintain a balanced portfolio. In concrete terms, this means that the offtake and injection in its portfolio must be balanced every quarter of an hour, taking into account the volumes traded on the electricity markets. In real time, however, BRPs may face imbalances, for example if a customer suddenly consumes more or a production installation produces less than expected. The imbalances of all Belgian BRPs partially cancel each other out, some BRPs have a positive imbalance (a surplus of energy), others a negative imbalance (a shortage of energy). The remaining imbalance is eliminated by the system operator Elia using balancing power, which it purchases in advance in the balancing markets organized for this purpose. In this way, Elia ensures that it has the necessary resources available at all times to maintain the system balance. Market players offering balancing capacity are remunerated on the basis of the price flow in the balancing market.

Who supplies balancing energy?

Historically, balancing energy was (mandatorily) offered by large power plants and large industrial users. Power plant operators could, for example, increase their production in the event of a shortage on the grid, or reduce it in the event of a surplus on the grid. Users can consume less when there is a shortage, and more when there is a surplus. The latter is often referred to as demand response, but it should be clear that balancing energy can be offered by both flexible producers and power consumers.

In order to reduce the cost of balancing energy and increase its reliability, Elia started working with the regulator to open up balancing markets to a larger group of market players. Today, all parties with at least 1 MW of (aggregated) flexible power can participate in the various balancing products. Of course, only once they have proven they meet the technical requirements.

Aggregators such as Next Kraftwerke merge various production, consumption and energy storage installations in a so-called Virtual Power Plant (VPP). The units in this VPP are then controlled and adjusted in a coordinated way to supply balancing energy to Elia. This makes it possible to gain a better market position, guarantee a reliable service to Elia and make optimal use of the complementarity of different technologies.

Elia's balancing products

The most important balancing products are discussed below.

| Balancing product (Belgian name) | Common European name | Explanation |

|---|---|---|

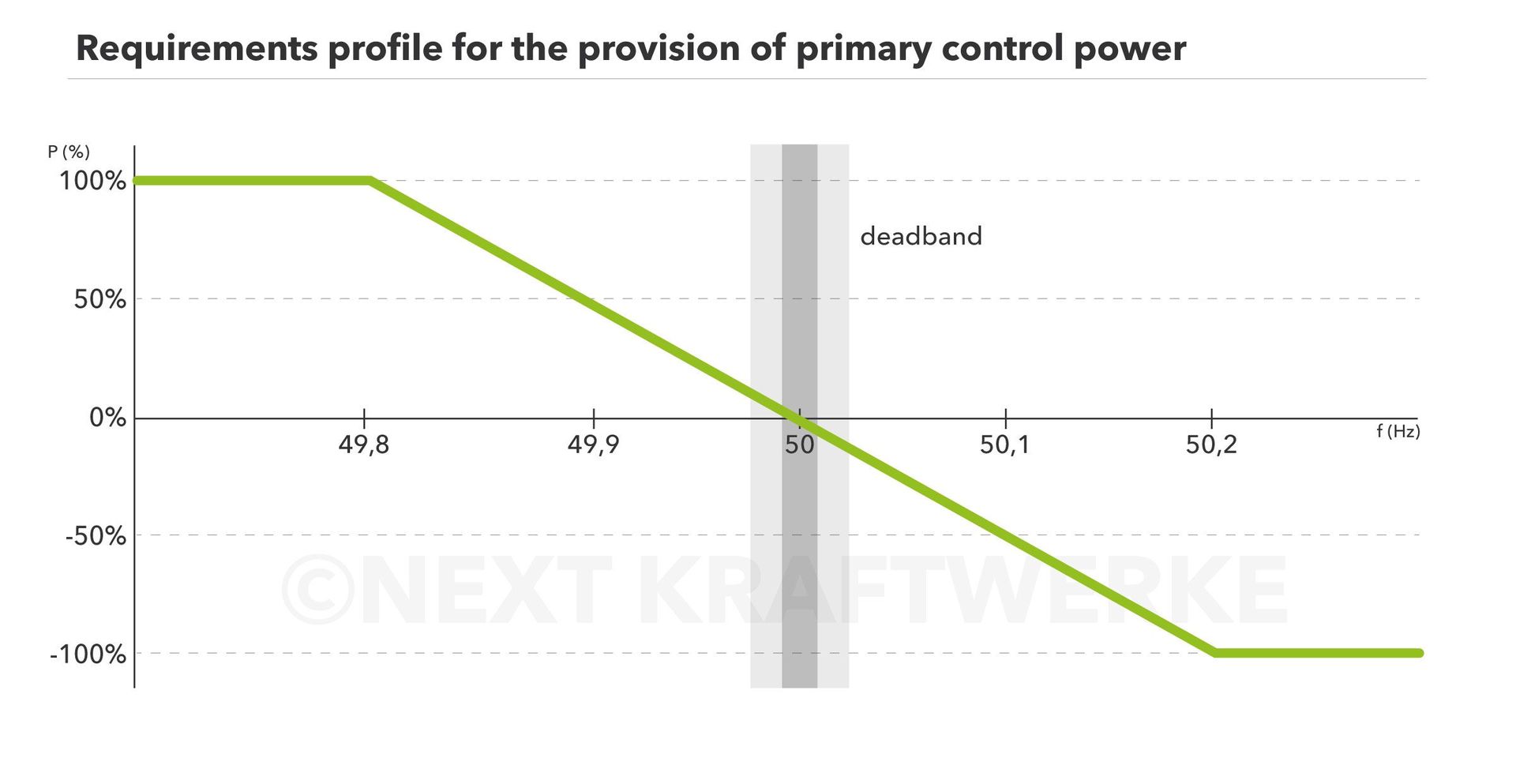

| Primary control (R1) | Frequency Containment Reserve (FCR) | Continuously monitors the frequency in the grid and will counteract any deviation from the reference frequency (50 Hz in Europe). The full FCR power should be delivered within 30 seconds if necessary. The aim is to limit the frequency deviations so that a collapse (black out) of the system is prevented. |

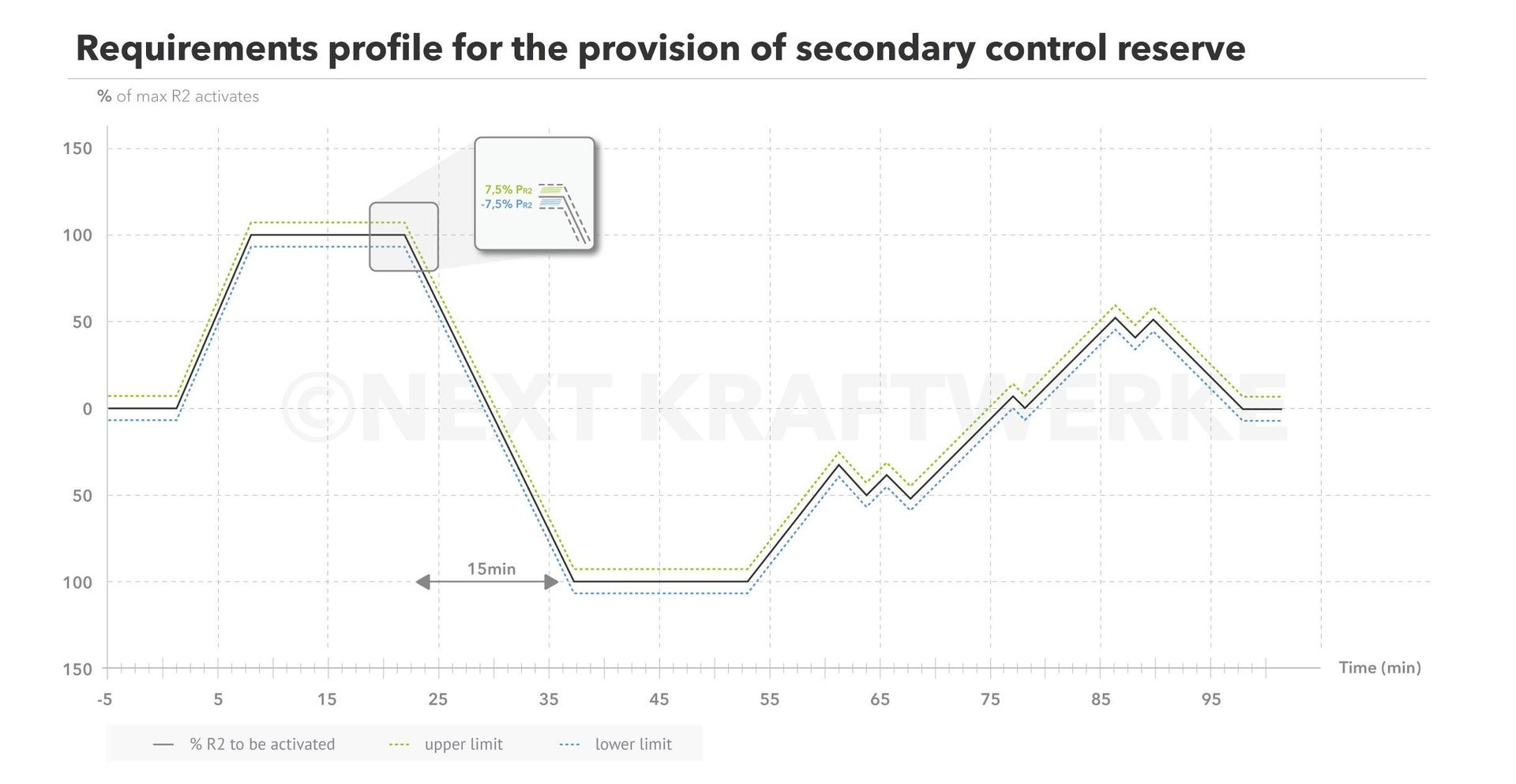

| Secondary control (R2) | Automatic Frequency Restoration Reserve (aFRR) | It is controlled centrally by Elia and must be able to be fully activated within 5 minutes. After activation, the system operator sends a new setpoint every 4 seconds, which must be followed within a strict accuracy band. This enables the grid operator to adjust the balance in a precise manner. |

| Tertiary control (R3) | Manual Frequency Restoration Reserve (mFRR) | Tertiary reserve is used to make the aFRR available again in case of large and prolonged imbalances and must be able to be fully activated within 15 minutes. In case of large imbalances, these reserves can support the mains frequency for minutes to hours. |

Capacity remuneration versus activation remuneration

Balancing energy is remunerated in two ways:

- Capacity or availability remuneration: this is the fee to keep capacity available to make adjustments when needed. All balancing products receive a capacity remuneration.

- Energy or activation remuneration: this is the compensation for the actual activation of the product by Elia. It is only paid on the aFRR and mFRR product.

Both remunerations are established in the balancing market. Elia first organises a capacity market, where various suppliers compete to sell balancing capacity to Elia. According to the merit order principle, the necessary volume is then contracted.

With aFRR and mFRR, the selected bidders then offer an energy price. Elia will activate the bidders according to the increasing energy price, again using the merit order principle.

In order to further increase competition, Elia also allows non-contracted parties to participate in energy bids. This is known as free bids. They are included in the merit order of energy offers and can therefore be activated if they are cheaper than contracted market players. Of course, they only receive an activation remuneration, not a reservation remuneration.

Deep dive in the balancing products (FCR, aFRR, mFRR)

FCR

Activation direction: Symmetric

Practical implications:

• Continuous upward and downward activations.

• Offered power is fully activated when the frequency deviates 200 mHz from the reference.

• Up and down activations compensate each other on average on a quarter hour basis. So, there is no imbalance as a result of the activations.

Market organisation:

• Tendering takes place via the international Regelleistung market.

• Some 86 MW are contracted, of which at least 30% are by Belgian suppliers.

• Daily bids for six 4-hour blocks.

• Reservation fee is paid-as-cleared.

• No activation fee.

aFRR

activation direction: Upward or downward

Practical implications:

• Fast and precise product: full power should be developed within 5 minutes. Set point is updated every 4 sec.

• Number of activations depends on energy price offered: from several activations per hour to a few activations per week.

• Activation duration: unlimited within the contracted 4-hour block.

Market organisation:

• Approximately 145 MW is contracted in both directions.

• Daily bids for six 4-hour blocks.

• Reservation fee is paid-as-bid.

• Activation fee is paid-as-bid.

More to read

mFRR

Activation direction: Upward (free bids in downward direction are possible)

Practical implications:

• Slowest product group: startup time of 15 min.

• Activated by grid operator as last resort product.

• Two contracted products in an upward direction: R3 Standard & R3 Flex (will be phased out by 2012).

• Number of activations depends on energy price offered, e.g. at 250 €/MWh: 20 hours/year in R3

• Activation time: unlimited within contracted 4-hour block;

• Imbalances due to activations are eliminated within the Transfer of Energy (ToE) framework.

Market organisation:

• Approximately 844 MW is contracted, of which at least 490 MW as mFRR standard.

• Daily bids for the six 4-hour blocks.

• Reservation fee is paid-as-bid.

• Activation fee is paid-as-cleared.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.